Tab 1

Whats New and Depreciation Overview

More

Adjustments to Basis Examples Chart

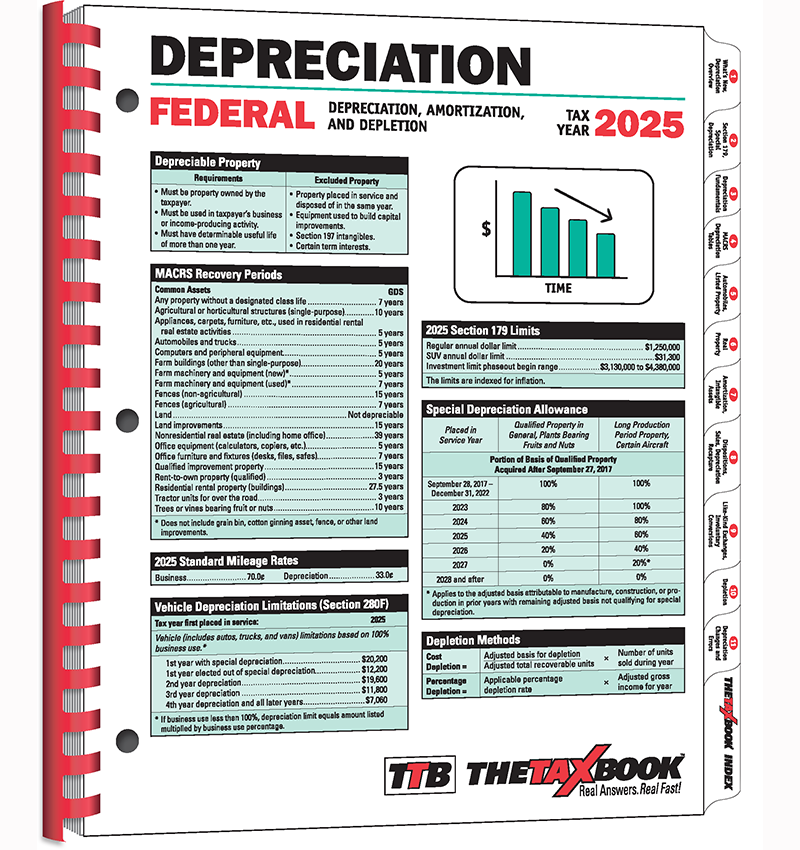

Depreciable Property Chart

Repairs vs. Improvements Chart

Leased Property—Incidents of Ownership Chart

Form 4562, Depreciation and Amortization Chart

Expiring Tax Provisions Chart

What's New Chart

Depreciation Overview

Basics of Depreciation

Placed in Service Date

Depreciation Allowed or Allowable

Property Requirements

Property Owned By the Taxpayer

Property Used in Business or Income-Producing Activity

Property Having a Determinable Useful Life

Property Lasting More Than One Year

Non-Depreciable Assets

Intangible Property

Cost Basis

Real Property

Adjusted Basis

Other Basis

Repairs and Improvements

Repairs and Improvements Flow Chart

Tangible Property Regulations

Improvements—Capitalization Required

Materials and Supplies

De Minimis Safe Harbor Election

Routine Maintenance Safe Harbor

Capitalize Repair and Maintenance Costs Election

Small Taxpayer Safe Harbor Election

Remodel-Refresh Safe Harbor

Leased Property

Rental of Property Used in Business

Lease or Purchase

Capitalizing Rent Expenses

Improvements by Lessee

Taxes on Leased Business Property

Cost of Getting a Lease

Tab 2

Section 179 and Special Depreciation

More

Common Property for Section 179 Deduction Chart

Section 179 Maximum Deduction and Investment Limit Chart

Special Depreciation Allowance Percentages Chart

Section 179 vs. Special Depreciation Chart

Section 179 Deduction

Section 179

Section 179 Limitations

Business Income Limit

Partnerships and S Corporations

Other Corporations

Situations That Affect Limits

Section 179 Property

Qualifying Property

Nonqualifying Property

Section 179 Carryover

Section 179 Election/Revocation

Section 179 Recapture

Special Depreciation Allowance

Special Depreciation (Bonus Depreciation)

Qualifying Property

Nonqualifying Property

Claiming Special Depreciation

Depreciable Basis

Special Depreciation Comparison Chart

Special Depreciation Recapture

Ordering Rules

Section 179 Deduction vs. Special Depreciation Allowance

Tab 3

Depreciation Fundamentals

More

AMT Depreciation Adjustments Chart

Half-Year Convention Depreciation Rates Chart

MACRS Recovery Periods for Commonly-Used Assets Chart

Recovering the Cost of Computer Software Chart

MACRS Recovery Periods Chart

MACRS Depreciation

Form 4562, Depreciation and Amortization

Regular MACRS (GDS)

Alternative Depreciation System (ADS)

Property Classes Under GDS

Computer Software

Placed-in-Service Date

Recovery Periods

Conventions

MACRS Depreciation Methods

Comparison of MACRS Depreciation Methods

Computing Depreciation

MACRS Percentage Tables

MACRS Worksheet

Computing the Deduction Without Using the Tables

Using the Applicable Convention

Examples

Farming Assets Depreciation

Property Used in Farming Business

Uniform Capitalization Rules for Farmers

Short Tax Year Depreciation

Short Tax Year

Short Tax Year Conventions

Computing Depreciation in a Short Tax Year

Short-Year Depreciation Formulas (First Year)

General Asset Account (GAA)

Depreciation Adjustments for Alternative Minimum Tax

AMT Depreciation Adjustments

Miscellaneous Depreciation Issues

Income Forecast Method [IRC §167(g)]

Unit of Production Method

Unit of Production Formula

Abandonment

Idle Property

Change of Use—MACRS Property

Indian Reservation Property

ACRS

Depreciation Recapture on Real Property Depreciated Under ACRS

Tab 4

MACRS Depreciation Tables

More

MACRS Recovery Periods for Commonly-Used Assets

MACRS Depreciation Tables Index

Half-Year Convention Depreciation Rates

Table A. 3-Year MACRS Property

Table B. 5-Year MACRS Property

Table C. 7-Year MACRS Property

Table D. 10-Year MACRS Property

Table E. 15-Year MACRS Property

Table F. 20-Year MACRS Property

Table G. Residential Rental Property Mid-Month Convention Straight Line—27.5 Years (GDS)

Table H. Nonresidential Real Property Mid-Month Convention Straight Line—31.5 Years (GDS)

Table I. Nonresidential Real Property Mid-Month Convention Straight Line—39 Years (GDS)

Table J. Straight Line Method Half-Year Convention

Table K. Straight Line Method Mid-Quarter Convention Placed in Service in First Quarter

Table L. Straight Line Method Mid-Quarter Convention Placed in Service in Second Quarter

Table M. Straight Line Method Mid-Quarter Convention Placed in Service in Third Quarter

Table N. Straight Line Method Mid-Quarter Convention Placed in Service in Fourth Quarter

Table O. Residential Rental Property Placed in Service After 2017 Straight Line Mid-Month Convention—30 Years (ADS)

Table P. Straight Line Mid-Month Convention—40 Years

Table Q. 150% Declining Balance Method Half-Year Convention

Table R. 150% Declining Balance Method Mid-Quarter Convention Property Placed in Service in First Quarter

Table S. 150% Declining Balance Method Mid-Quarter Convention Property Placed in Service in Second Quarter

Table T. 150% Declining Balance Method Mid-Quarter Convention Property Placed in Service in Third Quarter

Table U. 150% Declining Balance Method Mid-Quarter Convention Property Placed in Service in Fourth Quarter

Qualified Indian Reservation Property Tables for Property Placed in Service Before 2022

Table V. 2-Year Qualified Indian Reservation Property Half-Year and Mid-Quarter Conventions

Table W. 4-Year Qualified Indian Reservation Property Half-Year and Mid-Quarter Conventions

Table X. 6-Year Qualified Indian Reservation Property Half-Year and Mid-Quarter Conventions

Table Y. Qualified Nonresidential Real Indian Reservation Property Mid-Month Convention Straight Line—22 Years

Revenue Procedure 87-56, Recovery Classes, Class Lives, and Recovery Periods

Sec. 1. Purpose

Sec. 2. General Rules of Application

Sec. 3. Assigned Property With Assigned Class Lives, Recovery Classes, or Recovery Periods

Sec. 4. Prescription and Modification of Class Lives

Sec. 5. Tables of Class Lives and Recovery Periods

Sec. 6. Effect on Other Revenue Procedures

Tables of Class Lives and Recovery Periods

How To Use the Tables

Table 1. Table of Class Lives and Recovery Periods

Table 2. Table of Class Lives and Recovery Periods

Tab 5

Automobiles and Listed Property

More

Vehicle Depreciation Limitations (Section 280F) Chart

Section 179 Limits Chart

Standard Mileage Rate Per Mile Chart

When Are Transportation Expenses Deductible?

Auto Expenses Summary

Listed Property

Rules for Listed Property

Depreciation for Listed Property

Qualified Business Use

Lessee's Inclusion Amount—Other Than Passenger Automobiles

Recordkeeping for Listed Property

Reporting Listed Property

Business Autos

Business Use of Auto

Transportation vs. Travel

Commuting

Office in Home—Commuting Exception

Standard Mileage Rate vs. Actual Expenses

Standard Mileage Rate Method

Actual Expense Method

Luxury Auto Limits (Section 280F)

Section 280F Depreciation Limits

Qualified Nonpersonal-Use Vehicles

MACRS Depreciation on Business Autos

MACRS Depreciation on Business Autos

Depreciation After End of Recovery Period

Converting Personal-Use Auto to Business Use

Converting Business -Use Auto to Personal Use

Depreciation Recapture

Sale of Business Auto

Business Auto Trade-In Rules

Leased Autos

Vehicle Credits

Depreciation

Alternative Motor Vehicle Credit (Form 8910)

Alternative Fuel Vehicle Refueling Property Credit (Form 8911)

Qualified Plug-In Electric Drive Motor Vehicle Credit (Form 8936)

Lease Inclusion Tables

Rates to Compute Inclusion Amounts for Leased Listed Property

Business Mileage and Expense Log

Tab 6

MACRS Recovery Periods for Property Used in Rental Activities Chart

Farming Property and Buildings Recovery Periods Chart

Real Property Chart

Qualified Real Property Chart

Business Use of Home Methods Chart

Real Property

Property Requirements

Basis of Real Property

MACRS

Section 179 Deduction

Special Depreciation Allowance

Land

Roads

Parking

Signs and Billboards

Retail Motor Fuels Outlet

Rental Real Estate

Residential Rental Property

Depreciation Methods for Residential Rental Property

Conversion of Personal Property to Rental Use

Cooperatives

Nonresidential Real Property

Sale of Rental Property

Business Use of Home

Regular Method

Simplified Method

Employee Business Use of Home

Reporting Expenses for Business Use of the Home

Farm Buildings and Real Property

Land

Farm Buildings

Section 179 Eligible Property

Special Depreciation Eligible Property

Listed Property

Like-Kind Exchanges

Depletion

Qualified Improvement Property

Cost Segregation

Buildings and Structural Components

Cost Segregation Studies

Cost Segregation Court Cases—Real vs. Personal Property

Asset Classification—Hotel/Casino Industry

Asset Classification—Restaurant Industry

Asset Classification—Retail Industries

Asset Classification—Pharmaceutical and Biotechnology

Asset Classification—Auto Dealership Industry

Asset Classification—Auto Manufacturing Industry

Asset Classification—Electrical Distribution System

Asset Classification—Stand-Alone Open-Air Parking Structure

Tab 7

Amortization and Intangible Assets

More

Recovering the Cost of Computer Software Chart

Organizational Costs Chart

Intangibles Code Section Chart

Start-Up and Organizational Cost Deduction Limits Chart

Amortization

Amortizing Intangibles

Form 4562, Depreciation and Amortization

Section 197 Intangibles

Amortizing Section 197 Intangibles

Section 197 Intangibles Defined

Assets That Are Not Section 197 Intangibles

Safe Harbor for Creative Property Costs

Anti-Churning Rules

Incorrect Amount of Amortization Deducted

Disposition of Section 197 Intangibles

Business Start-Up Costs and Organizational Costs

Business Start-Up Costs

Costs of Organizing a Corporation

Costs of Organizing a Partnership

Amortization and Deduction

How to Make the Amortization Election

Getting a Lease

Points

Home Mortgage Points

Business and Investment Property

Research and Experimental Costs

Reforestation Costs

Geological and Geophysical Costs

Income Forecast Method

Pollution Control Facilities

Optional Write-Off of Certain Tax Preferences

Tab 8

Disposition, Sales, and Depreciation Recapture

More

Types of Property Chart

Reporting Sales of Business Property (Form 4797) Chart

Gain on Sale of Business Property Chart

Dispositions and Sales

Disposing of Business Property

Capital Gain Tax Rates

Section 1231 Transactions

Section 1231 Gains and Losses

Depreciation Recapture

General Asset Accounts

Section 1245 Property

Section 1245 Gain Treated as Ordinary Income

Section 1250 Property

Sale of MACRS Real Property

Additional Depreciation

Applicable Percentage

Section 1250 Gain Treated as Ordinary Income

Unrecaptured Section 1250 Gain

Reporting on Form 4797, Sales of Business Property

Dispositions of Improved Property

Net Investment Income Tax

Depreciation Recapture—Other Situations

Depreciation Recapture—Section 179

Depreciation Recapture—Special Depreciation Allowance

Excess Depreciation—Listed Property

Gifts

Transfers at Death

Multiple Property Dispositions

Other Dispositions

Sale of a Business

Dispositions of Intangible Property

Subdivision of Land

Timber

Precious Metals and Stones, Stamps, and Coins

Coal and Iron Ore

Conversion Transactions

Qualified Opportunity Fund

Virtual Currency

Farm Dispositions

Sales of Farm Products

Dispositions of Farm Assets

Farm Depreciation Recapture

Sale of a Farm

Installment Sales

Installment Sale Income (Form 6252)

Calculating Installment Sale Income

Reporting Installment Sale Income

Interest on Deferred Tax

Installment Sale to a Related Party

Buyer Assumes Mortgage

Selling Price Reduced in Subsequent Year

Unrecaptured Section 1250 Gain—Installment Sale

Pledge Rule (Installment Obligations Used as Security)

Electing Out of an Installment Sale

Installment Sale Depreciation Recapture

Foreclosure or Repossession

Foreclosure or Repossession—Buyer

Seller's (Lender's) Gain or Loss on Repossession

Installment Sale Repossessions

Tab 9

Like-Kind Exchanges and Involuntary Conversions

More

Basis of Replacement Property Chart

Depreciation After Exchange or Conversion Chart

Property Requirements Like-Kind Exchange Chart

Like-Kind Property Chart

Like-Kind Exchange—Gain Realized Chart

Like-Kind Exchange—Gain Recognized Chart

Involuntary Conversions Chart

Like-Kind Exchanges

Property Requirements Like-Kind Exchange

Gain Recognized

Basis of Like-Kind Property Received

Related Parties

Reporting Like-Kind Exchanges, Form 8824

Deferred Exchanges

Safe Harbors Against Actual and Constructive Receipt in Deferred Exchanges

Parking Transactions

Partially Nontaxable Exchanges

Multiple Property Exchanges

Partial Dispositions of MACRS Property

Involuntary Conversions

Condemnations

Gain or Loss From Condemnations

Postponement of Gain

Replacement Property

Replacement Period

Determining When Gain is Realized

Election to Postpone Gain

Reporting a Condemnation Gain or Loss

Depreciation for Like-Kind Exchanges and Involuntary Conversions

Depreciating Replacement Property

Default Rules Summary

Determination of Depreciation Allowance

Election Out of Depreciation Default Rules

Property Acquired in a Nontaxable Transfer

Form 8824 Illustrated Example

Tab 10

Depletion Methods Chart

Economic Interest Chart

Percentage Depletion Use Chart

Deposits Percentage Depletion Rates [IRC §613(b)] Chart

Oil or Gas Percentage Depletion Rates Chart

Depletion

Depletion Deduction

Economic Interest in Mineral Property or Timber

Alternative Minimum Tax (AMT) Adjustment

Depletion Methods

Cost Depletion

Percentage Depletion

Mineral Property

Oil and Gas Wells

Economic Interest in Oil or Gas Property

Percentage Depletion—Oil and Gas Wells

Calculating Percentage Depletion

Partnerships and S Corporations

Enhanced Oil Recovery Credit (Form 8830)

Natural Gas Wells

Mines and Geothermal Deposits

Mines and Other Natural Deposits

Geothermal Deposits

Timber

Timber Depletion

Elections

Form T (Timber), Forest Activities Schedule

Tab 11

Depreciation Changes and Errors

More

Changing Depreciation Accounting Methods Chart

Correcting Depreciation Errors Chart

IRC Section 481(a) Adjustment Recognition Period Chart

Common Depreciation Automatic Accounting Method Changes for Form 3115 Chart

How to Correct Depreciation Errors

Filing an Amended Return

Requesting a Change in Accounting Method

Change in Accounting Method

IRC Section 481(a) Adjustment

Taxpayers Under Examination

Depreciation Errors on Disposed of Assets

Gain or Loss on Asset Disposition

Making the Change

Example for Filled-In Form 3115