Deluxe Deal

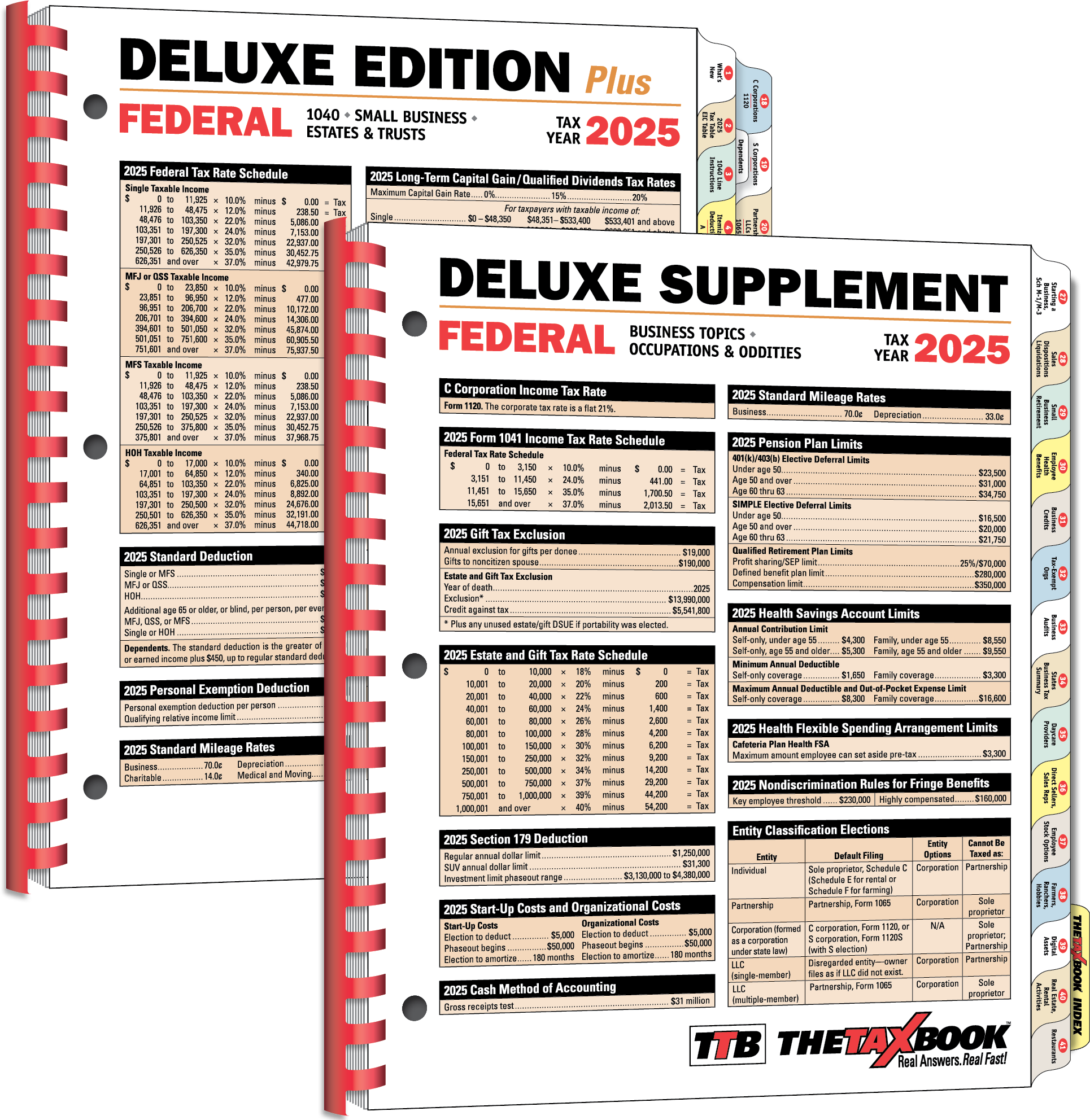

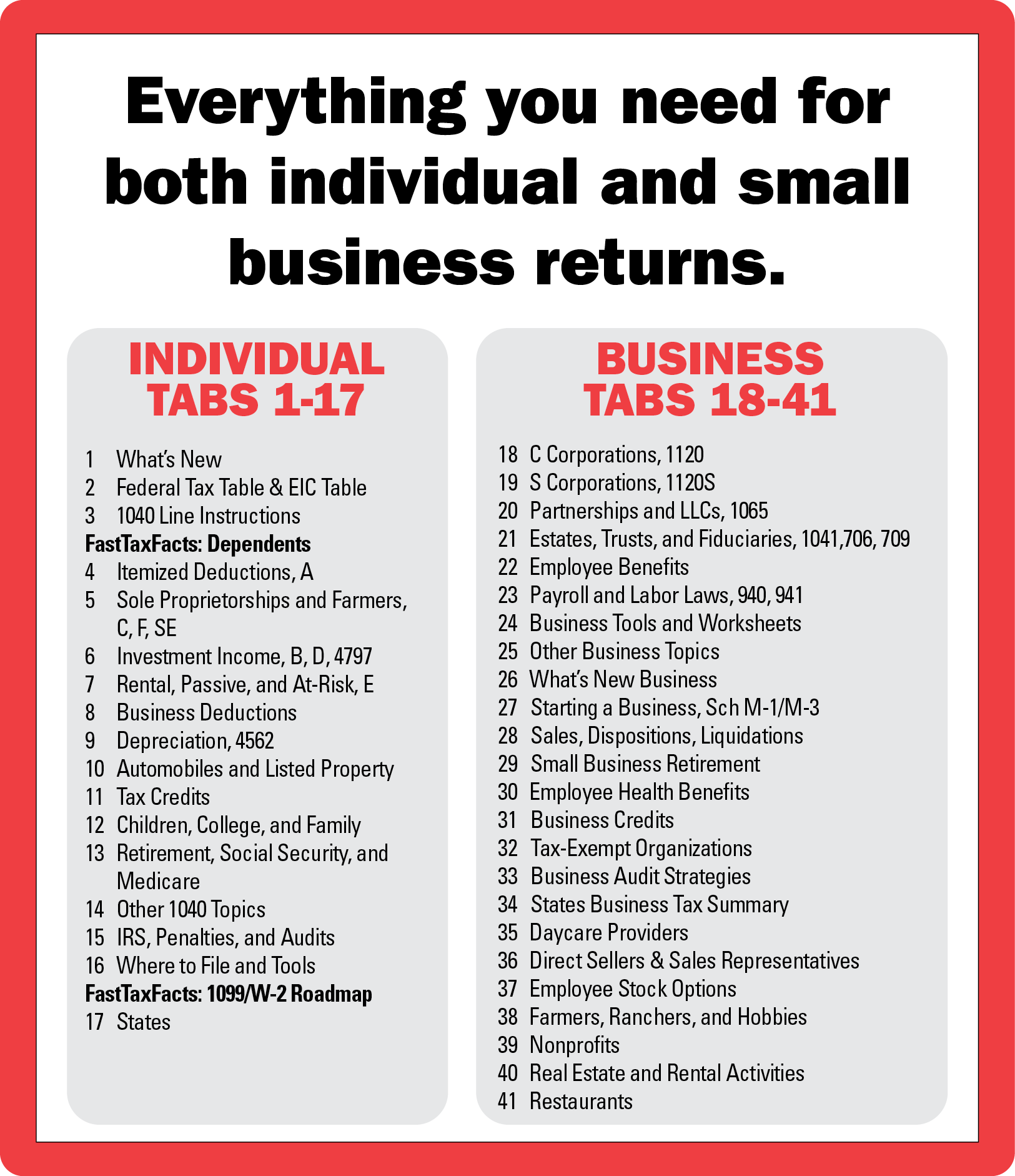

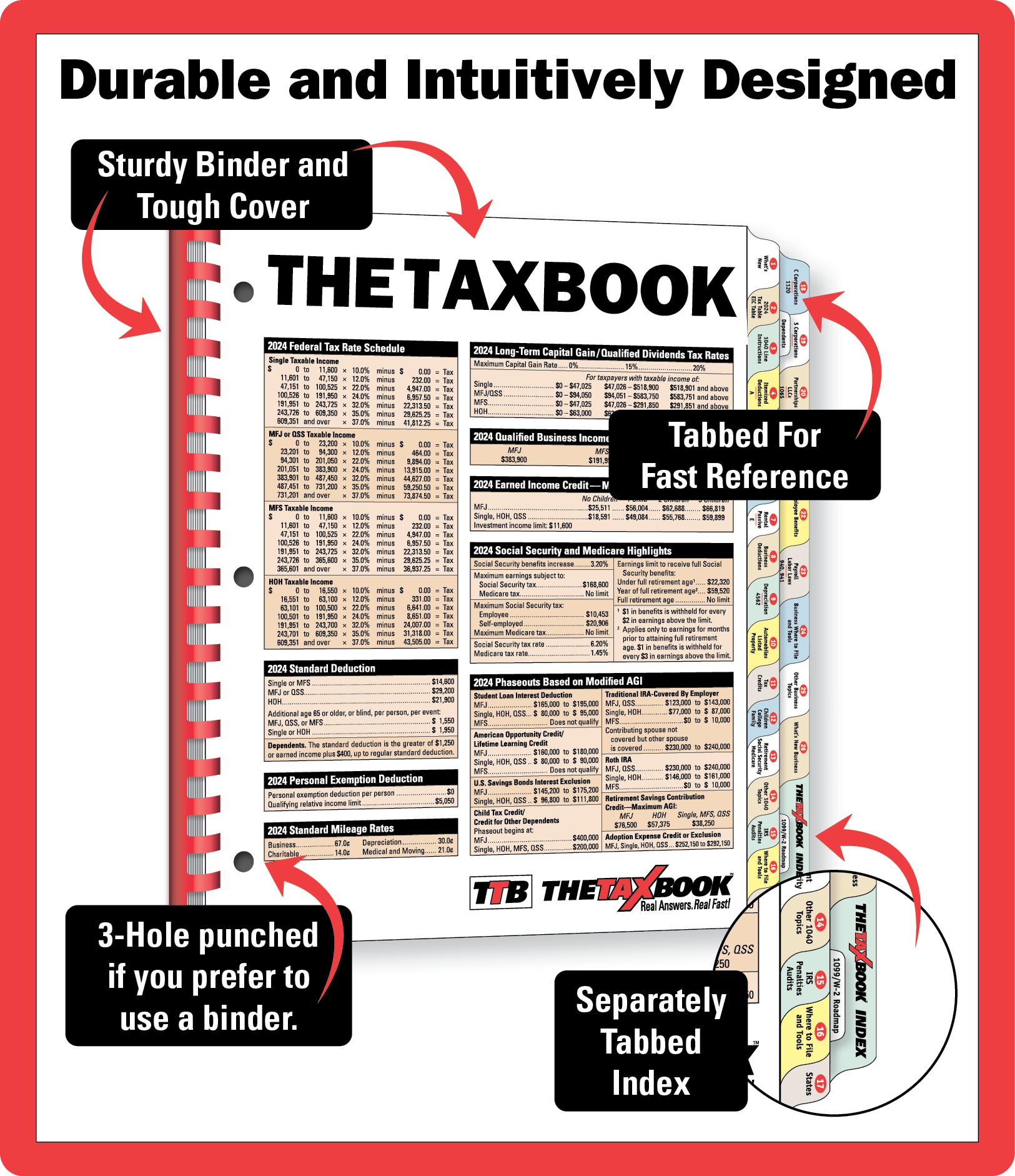

The Deluxe Edition Plus is our best seller! The book contains both individual and small business information. Find information fast, with well-written and easy-to-understand explanations and examples. The Deluxe Supplement is the perfect complement to the Deluxe Edition Plus. Find expanded coverage of small business topics and complex occupations and situations. Purchase both and save!

| Deluxe Deal Includes | Retail Value |

|---|---|

| Deluxe Supplement | $89 |

| Deluxe Edition Plus | $119 |

| Free Shipping | $16 |

| Total Retail Value | $224 |

Start Ship Dates

- Deluxe Supplement, 12/15/25

- Deluxe Edition Plus, 12/15/25