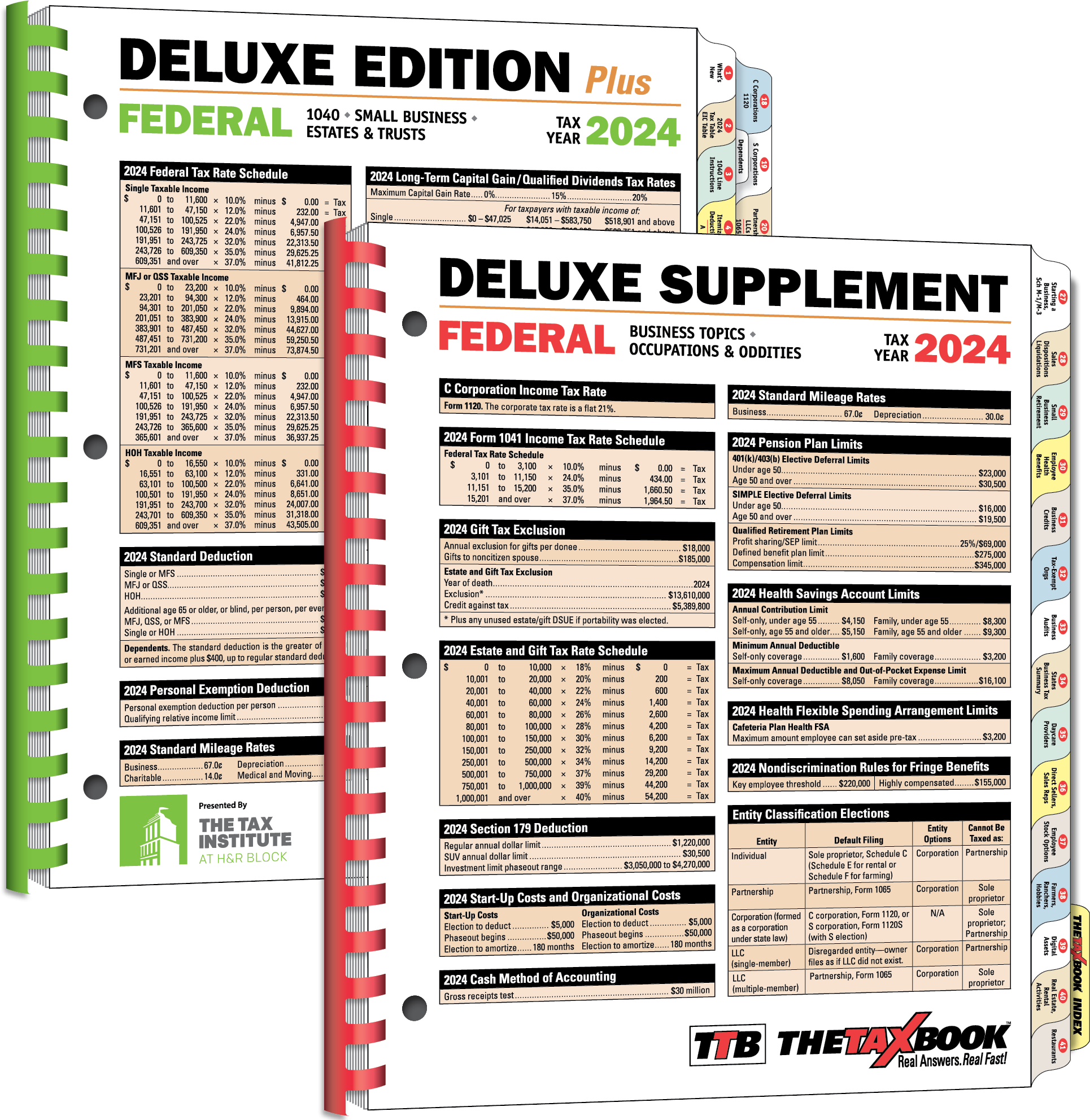

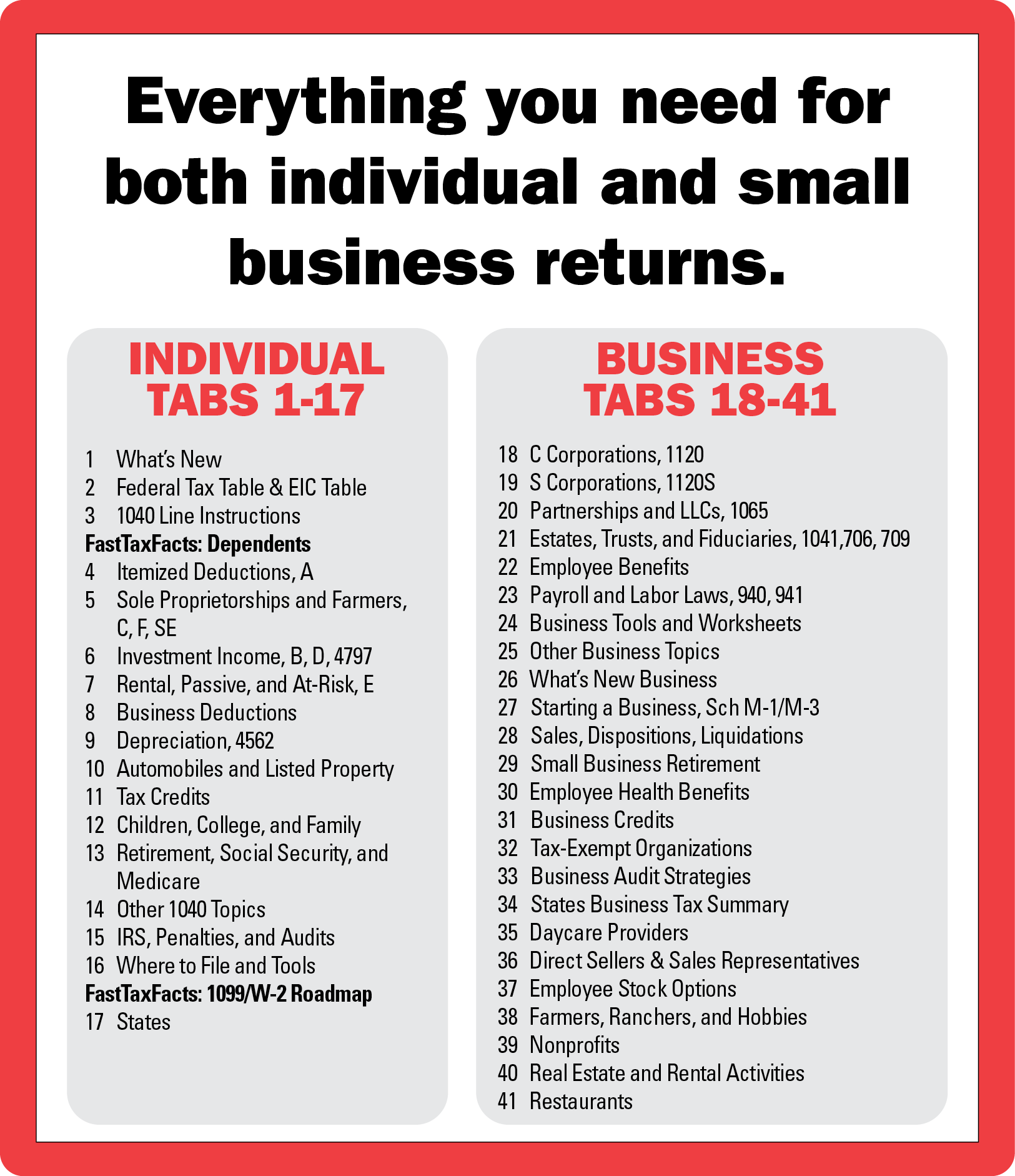

Deluxe Edition Plus Content Highlights

Individual, Schedules A, B, C, D, E, F, SE, C Corporations, S Corporations, Partnerships,

Estates & Trusts, Dependents FastTaxFacts, 1099/W-2 Roadmap FastTaxFacts, and more.

Click

here for more information.

Deluxe Supplement Content Highlights

Starting a Business, Sales, Dispositions, Liquidations, Retirement,

Employee Health Benefits, Business Credits Tax-Exempt Organizations,

Employee Health Benefits, Business Audit Strategies, and more.

Click

here for more information.

It's Difficult to Keep it All Straight

Keeping the over 9 million words of constantly changing tax code straight is a daunting task.

New Tax Law, Revenue Rulings, Filing Requirements, Phase-Outs, Dependency Rules; it's a lot to remember!

Our authors take this massive amount of information and place it in a fast-answer format that makes finding your answer easy.

Our Customers Tell Us

- They find answers to 90-95% of their tax questions in TheTaxBook.

- On average, they save 10-15 minutes per question by referencing TheTaxBook.

- They reference TheTaxBook 2-3 times a day during tax season!

- 86% of our customers keep TheTaxBook within arm's reach during tax season.